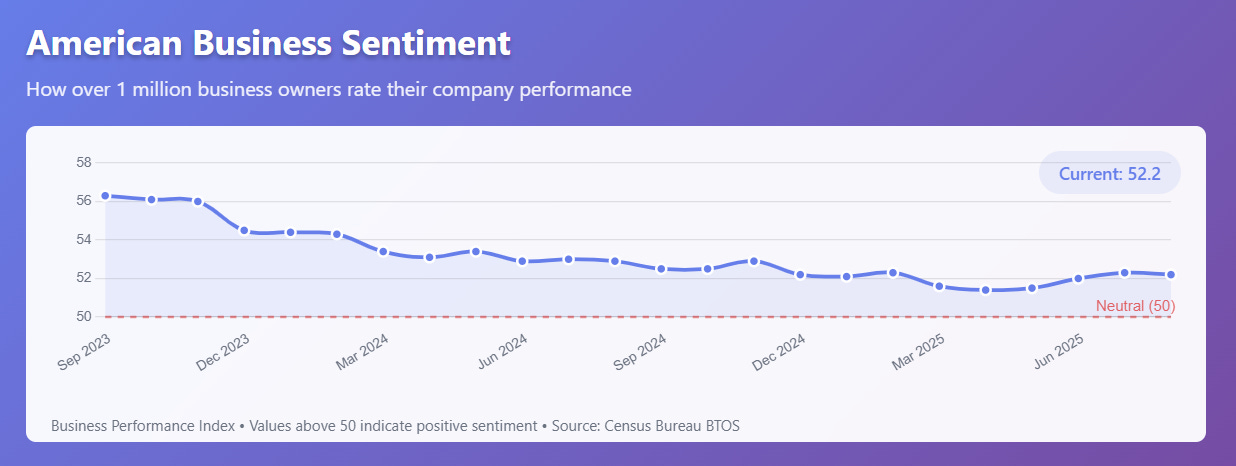

Every two weeks, the Census Bureau asks over a million American business owners how business is going. Their answers reveal what's really happening in the economy, without Wall Street spin or political framing.

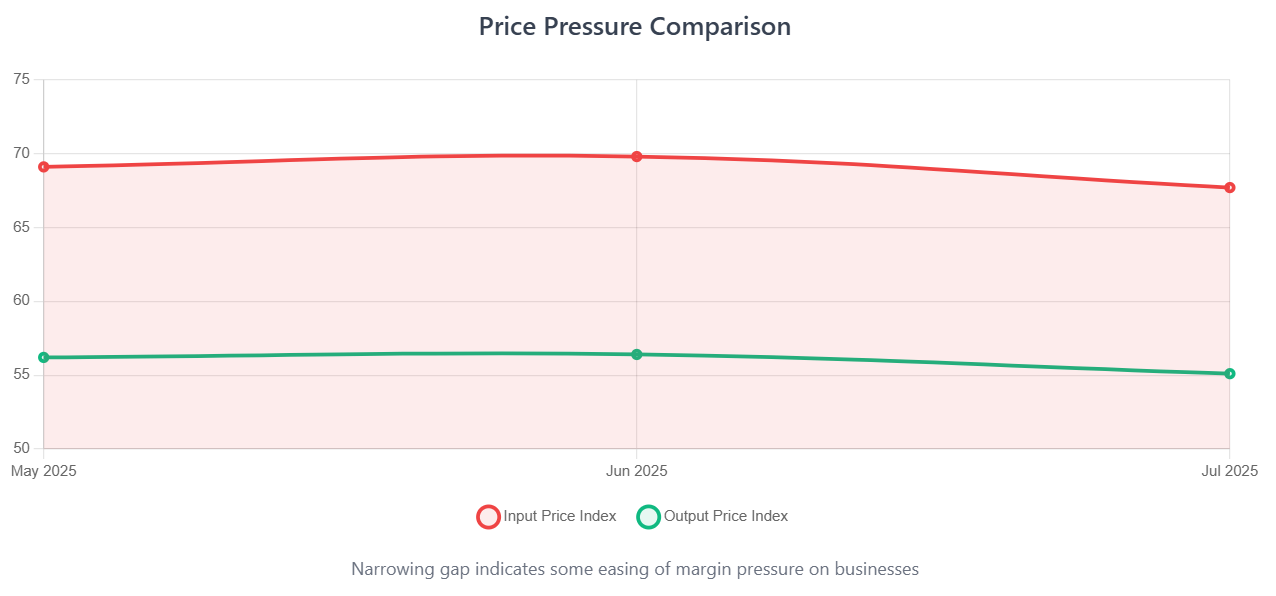

The latest data shows American businesses facing a big profit squeeze. Costs are rising much faster than they can raise prices. If you want to see a full dashboard with additional data from the BTOS bi-weekly survey, check this out!

The Numbers

38.5% of businesses say their costs went up in the past two weeks. Only 15.7% raised their prices. That's a 22.8-point gap eating into profits across the economy.

The Input Price Index hit 67.7, while the Output Price Index sits at 55.1. Businesses are absorbing some cost increases while passing the rest onto customers.

Key Numbers

38.5%: Businesses with higher costs

15.7%: Businesses that raised prices

22.8 points: The profit-crushing gap

Revenue Is Falling Too

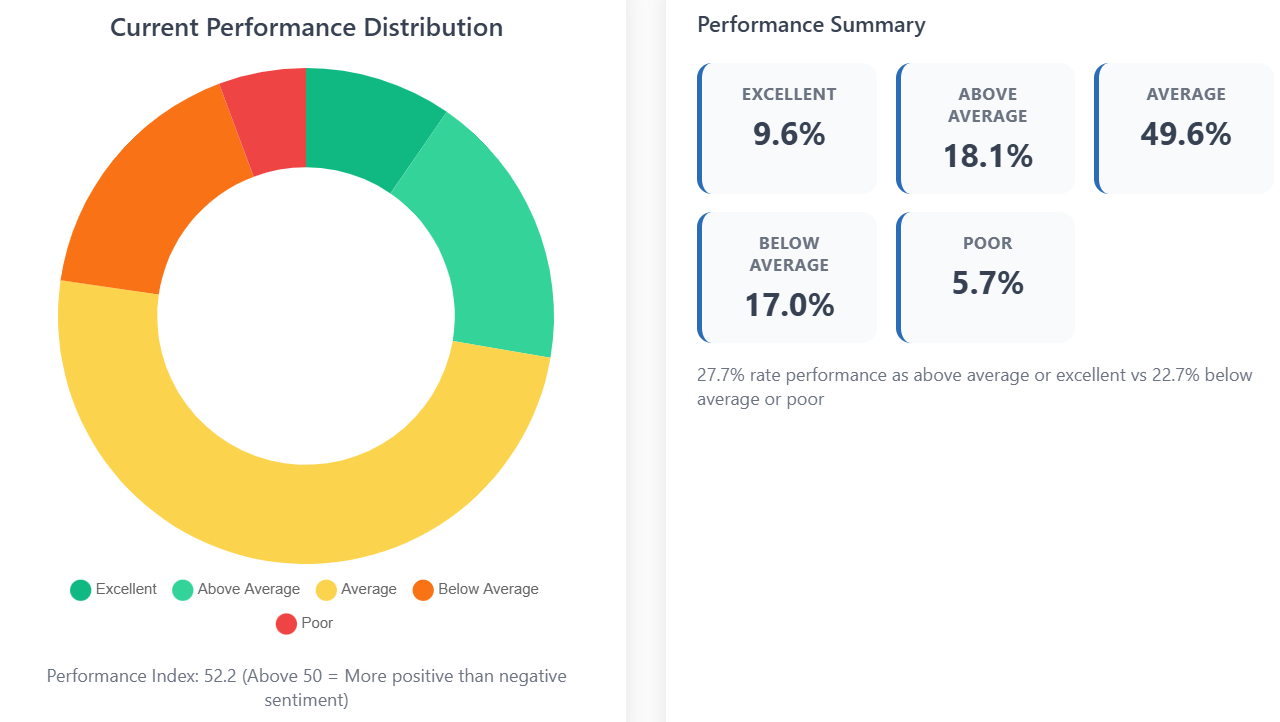

The Revenue Index is 41.7—well below 50, which means more businesses are losing revenue than gaining it.

30.1% of businesses had revenue decreases in the past two weeks. Only 13.6% had increases. That's more than 2-to-1 against.

When costs go up and revenue goes down, profit margins get crushed. That's exactly what's happening.

How Businesses Are Responding

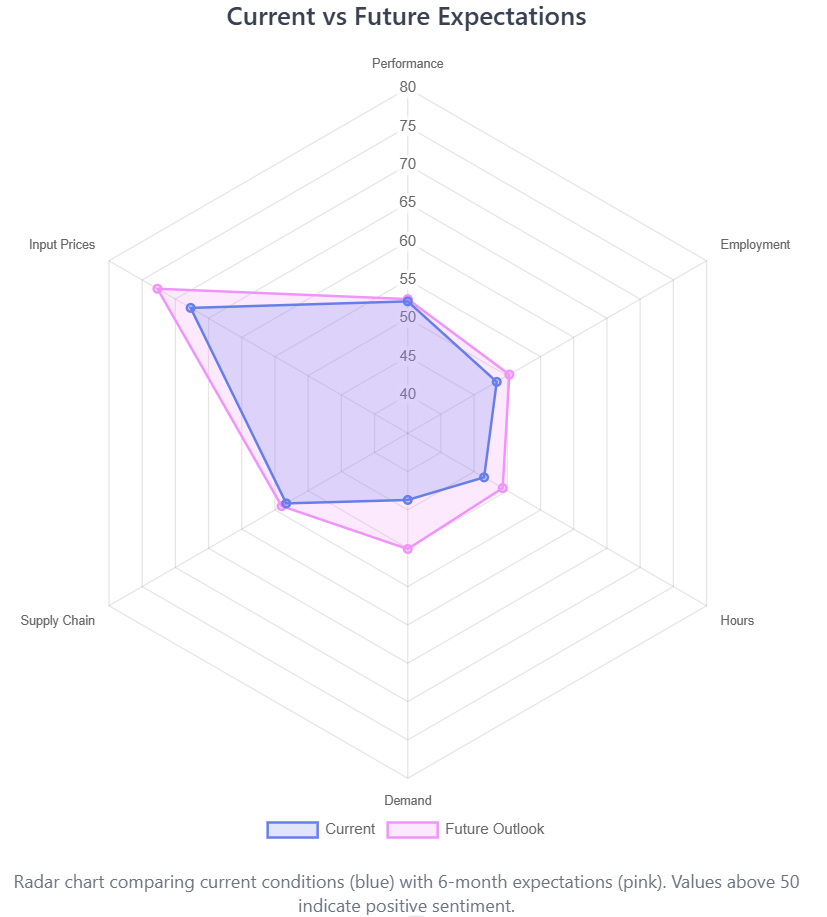

Instead of mass layoffs, businesses are cutting hours. 15.5% reduced employee hours while only 9.4% cut jobs.

This keeps trained workers but means smaller paychecks. The Employment Index shows slight job losses at 48.4, but the Hours Index dropped to 46.5.

Labor Numbers

Employment Index: 48.4 (slight job losses)

Hours Index: 46.5 (big cuts to work hours)

Remote Work: 42.5% of businesses

What Businesses Expect

Business owners think things will get better in six months. The Future Demand Index rises from 43.7 to 50.1. They're planning modest hiring—employment expectations improve from 48.4 to 50.3.

But they also expect costs to keep rising. The Future Input Price Index jumps from 67.7 to 72.7.

So their forecast is: demand will recover, but costs will get worse.

What This Means

We're watching businesses adapt to strong margin pressures. If demand recovers as they expect, they might regain pricing power and restore profits.

If demand stays weak while costs keep rising, we'll see bigger changes: more cost cutting, delayed investments, or fundamental business model shifts.

The labor approach, cutting hours instead of jobs, helps preserve skills but reduces consumer spending power.

What to Watch

Does demand actually recover?

Can businesses start raising prices?

Do work hours stabilize?

Do supply chains improve?

The next few months will show whether this margin squeeze is temporary or signals a bigger economic shift. Business owners are cautiously optimistic, but the data shows they're under real pressure right now.

About This Analysis: The Business Pulse translates the Census Bureau's Business Trends and Outlook Survey into plain English. Every two weeks, I analyze responses from over 1.2 million business owners to show what's really happening in the economy.

Data source: U.S. Census Bureau Business Trends and Outlook Survey, June 16-29, 2025.